It’s been pretty hard to ignore that the cost of living is increasing. Where have you been if you didn’t realise that petrol and diesel is around £2 per litre now, depending on where your local filling station is. Gas, Electric, Oil, Food….. the cost of everything is going up. Which isn’t all that welcome.

For anyone who has been watching their investment news, chances are you are getting pretty uncomfortable watching it go down at the same time. Trust us – it’s uncomfortable for everyone.

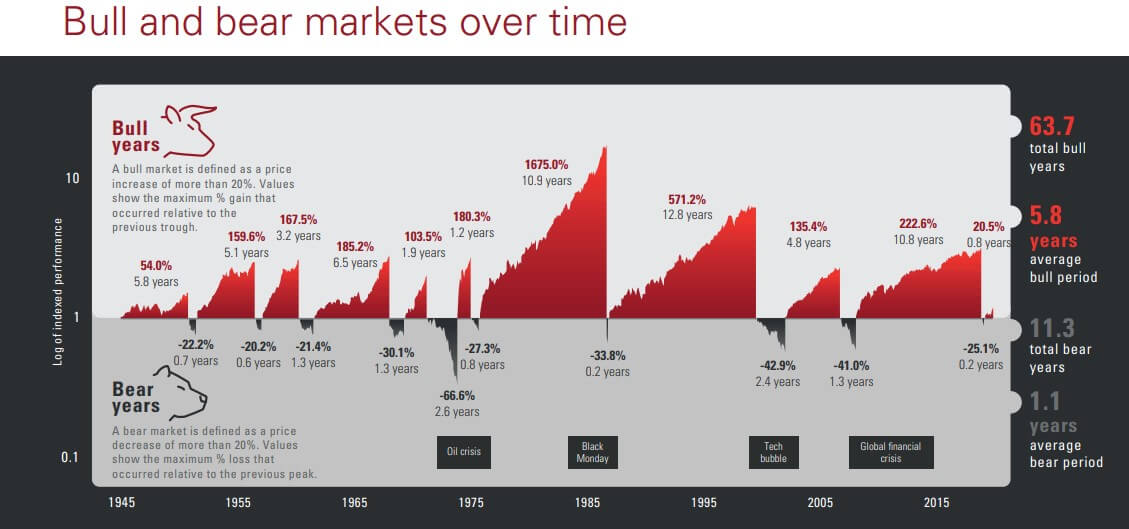

Bear and Bull Markets

Stock markets around the world are entering what is known as a “Bear Market.” This means that they are now down 20% since their recent high. It’s called a Bear Market, because when things aren’t looking good (weatherwise) a bear retreats to shelter and hibernates.

The opposite of a Bear Market is a Bull Market, when markets are up 20%. It’s a bull because bulls are known to charge, and so prices are charging upwards.

This was an old chart which showed the length and size of Bear (in black) and Bull Markets (in red) up to 2020, produced by Vanguard. I’d be keen to see an updated one which would include the Covid crisis, but I’ve never seen one yet. Here’s the link to it for full info – https://www.vanguard.co.uk/content/dam/intl/europe/documents/en/bear-and-bull-chart-eu-en-end.pdf

The key takeaway is look at how much longer a Bull Market (upward market) lasts compared to Bear Markets. It doesn’t make it any easier, but it shows that this is normal.

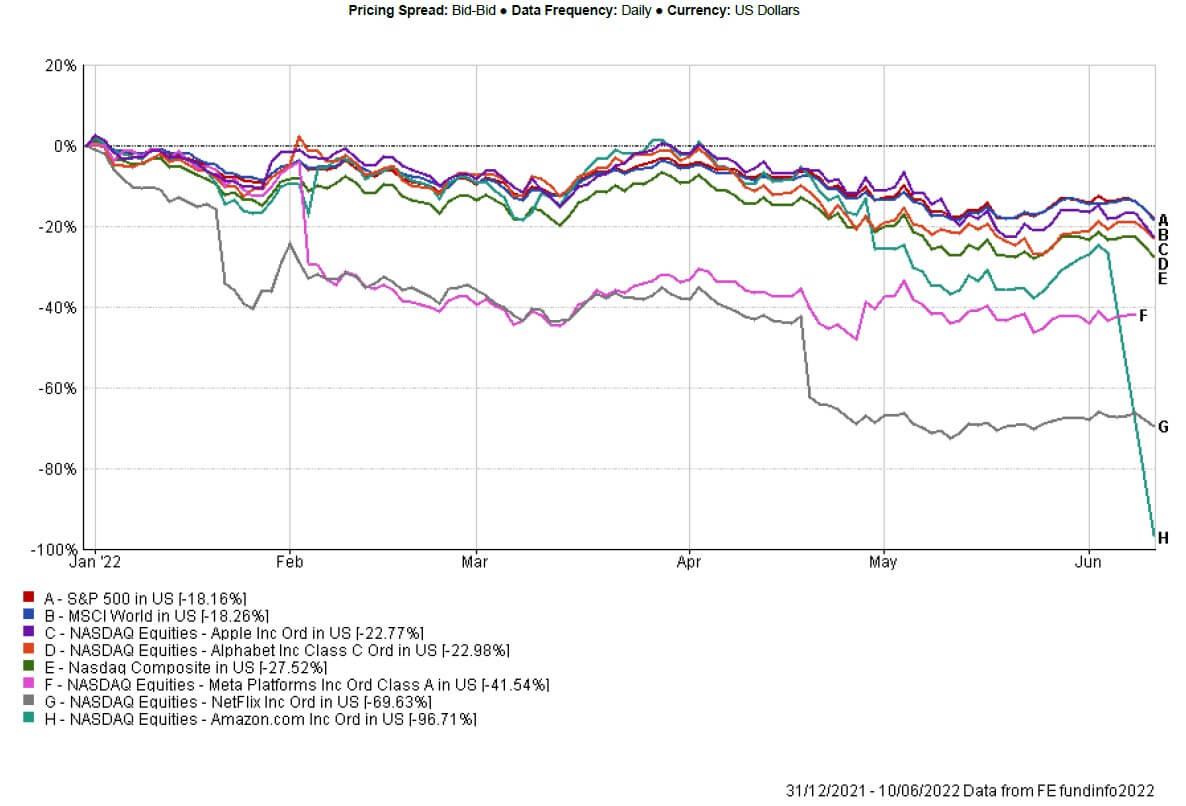

Stock Market FAANGs

The stock market indices are the best indicator of how markets are doing. The S&P 500 (the 500 largest companies in the US) or the NASDAQ COMPOSITE (heavily focused on US technology and information services – think Apple, Amazon, Google etc) are arguably the best indicators. They’ve had a very difficult 2022 so far.

To bring some life to it, let’s look at the 5 companies we used to call the FAANGs. Facebook (now Meta Technologies), Apple, Amazon, Netflix and Google (now Alphabet) are 5 companies we all know very well and the majority of us use their products and services many times every day. It’s hard to imagine life without these companies. How has their 2022 been going?

It’s not pretty! *The S&P 500 and MSCI World are both down 18%. The Nasdaq Composite, labelled E above, is down 27.52% until 13th June 2021. At time of writing, the US market is still open and both are currently down a further 3%. This would mean the S&P officially entered a Bear Market today.

It’s not pretty! *The S&P 500 and MSCI World are both down 18%. The Nasdaq Composite, labelled E above, is down 27.52% until 13th June 2021. At time of writing, the US market is still open and both are currently down a further 3%. This would mean the S&P officially entered a Bear Market today.

Apple, the biggest company (financially anyway) and Alphabet (Google) are down almost 23%. Meta (formerly Facebook) is down 41%. Netflix has dropped 69%.

Disclaimer: Amazon isn’t actually down 97%! That would be truly terrifying! On 3rd June, they did a 1:20 stock split. What that means is they simply divided each share into 20 shares, to lower the price of the shares to make them more affordable for people to buy. This result in the share price dropping from around $2000 per share to a new price of $109. The true share price is down almost 39% this year to date, not 97%!!!

Some of these figures are scary! There’s no easy way to say it. Our client portfolios are down between 5 – 10% depending on the risk taken. Riskier portfolios are down more than the less risky portfolios.

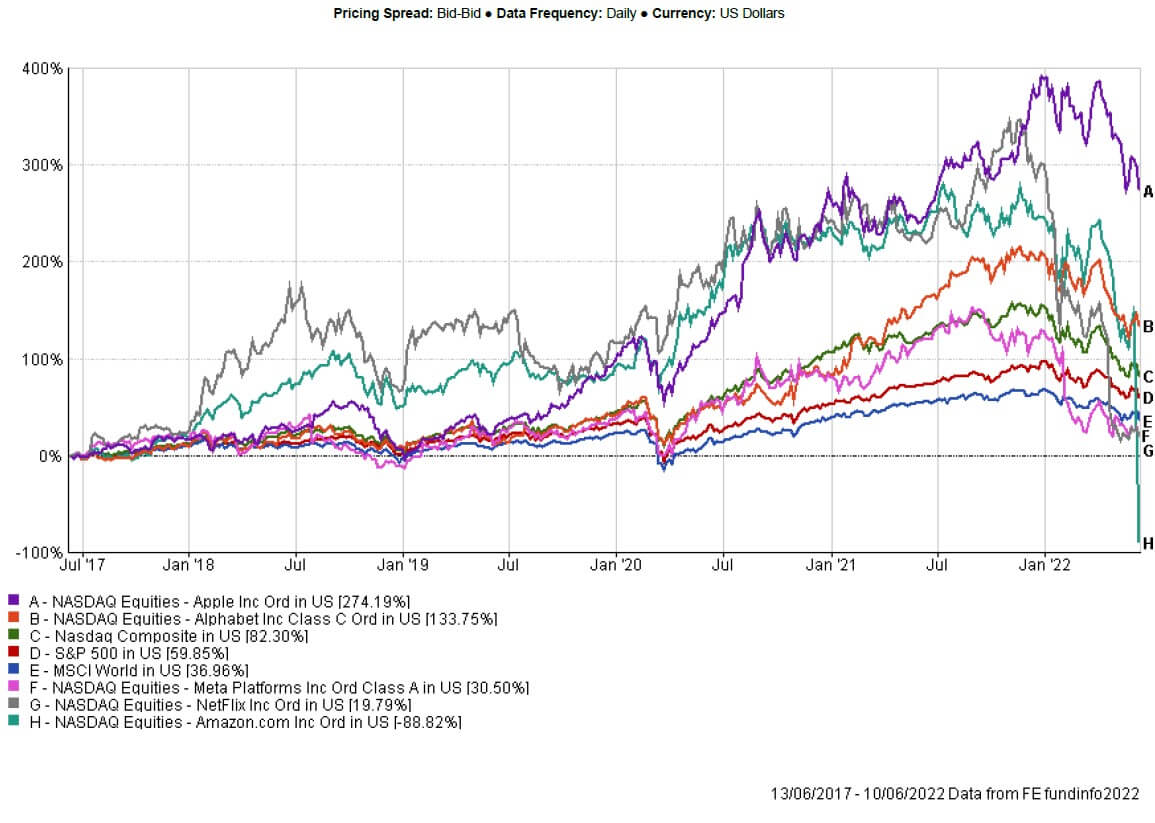

It’s About the Big Picture

You probably think I’ve under-egged it when I say it’s uncomfortable. But the fact remains, not one of our clients has invested to make a 6 month return. Yes – it would be great if it was a nice positive number in these last 6 months. But that’s a pretty short time in investing. If we look at the big picture, for just 5 years, then the picture is somewhat different. Remember that most clients are investing for 10, 20, 30 maybe even 40 + years, so 5 years isn’t very long. But when we are comparing numbers with individual shares, the numbers can get very silly.

This shows an altogether different picture. In the last 5 years, an investment solely in the NASDAQ Composite would have made 82%, the S&P 500 almost 60% and MSCI World is 37%. If you have been unbelievably brave (or arguably stupid), and risked everything on just one stock, then –

- Apple would have made 275%, despite losing 23% in the last 6 months

- Alphabet has made 133%

- Meta/Facebook 30%

- Netflix 20%

- Amazon’s total return is unrealistic and unfair due to their stock split. It should be up 109%

An Investment Philosophy You Can Stick With

Successful stock picking requires a whole lot of luck.

Hindsight is a wonderful thing, so you could say that Apple and Google/Alphabet were obvious choices. But of the giants in the world of business, only 3 have beaten the indices over 5 years. You need the heart of a lion and an iron stomach to put all of your money into one share. I would argue it’s stupid and reckless, but some people hold great conviction in their selection. You need the analytical skills of millions of analysts and computers to pick the right one. But the thing you really need is a whole bunch of luck. Luck to pick the right one. Luck on when you buy it. And luck on when to sell it.

There is no “star stock-picker” who has consistently turned up and picked the best stocks every time for a sustained period of time. Yes, there are stories of people who can do it for a year or two. But nobody who has been doing it for 30 or 40 years with total success.

If you did pick an individual stock, you would have missed out on the other star companies. In the same 5 years, Tesla is up 826%. Who is going to be the next star company? Who knows? Do a quick search online and you’ll find countless articles all naming the top 5 stocks to buy today, and almost every article names 5 different ones.

Individual shares are scary. They are off-the-chart risky. You could become a millionaire or bankrupt overnight. It’s that scary. You need an investment philosophy you are comfortable with, but most importantly, one you can stick with no matter what happens.

We believe in holding a well-diversified, global portfolio spreading money around thousands of different investments. We don’t pick which ones we think will beat others, because we’ve a good chance that we would get it wrong. Our philosophy is steady long term growth. If you think you’ve found the next superstar, take money you can afford to lose, and go do it on your own. If you want to find out more without talking to us, revisit our Technical Tuesday videos on our Youtube channel here

We can’t and won’t advise on individual shares or companies.

So What Do We Do Now?

We stick with the plan. Simple as that. Nothing has changed. We knew this would eventually happen, and it will happen again. It will eventually bounce back. We don’t know when, but it will.

You still own everything you owned at the beginning of the year. You still hold the same number of units of the investments you had (remember our blog when Russia first invaded Ukraine and we spoke about this?) The units are just valued less at the moment. It’s like if you had your house valued every day, you only lock in a loss if you sell.

Some people might even see this as an opportunity to invest money they’ve been holding in cash because markets are down. They are getting more for their money. That’s why monthly savers benefit from declining markets. There’s a famous Warren Buffett quote – “Be fearful when others are greedy, and greedy when others are fearful.”

If you have concerns then remember that we are here to help you. Please lift the phone or email us. We will no doubt be doubling down on these investment related blogs and showing you more of the technical evidence which shows this is completely normal.

We’re hurting too, but this is where we demonstrate real value to clients. If you need reassurance, someone to lean on, or who knows, a pearl of wisdom which we might unwittingly reveal, talk to us. You aren’t in this alone.

*Year to date declines taken from FE Analytics on 13 June 2022

Past Performance is not a guarantee of future return. Investments can go down as well as up, and you may not get back the full amount you originally invested.

We do not advise on individual shares

This communication is for general information only and is not intended to be construed as individual advice.

Modulus FP is not responsible for the accuracy of the information contained within the linked third party site / literature.