The thing about a rollercoaster is once you’re on, you ride until the end.

You’ve heard people tell you about their time on Oblivion, the Big One (formerly the Pepsi Max), or even our very own, Barry’s Big Dipper, and it always sounds great. “If they can do it, so can I.”

But it’s all well and good until you’re there, in the queue waiting to board. You hear the screams; the noises. You see the height and the speed. Suddenly it’s real. Suddenly it’s personal. And maybe you don’t quite get onboard…

Investing is just like getting on that roller coaster.

The Roller Coaster of Investing

We’ve all heard the stories of the great times people have had when they invested. They made good money, it wasn’t scary, and anyone can do it. But it might just seem different when you put yourself in that position.

When you’re going on a rollercoaster, you’ll look at the height, the speed, the turns, the loop the loops and you decide whether or not it’s for you. I’m going to liken that to your risk tolerance. It’s just how you view something, and there isn’t anything that I can say which is going to make your time on that ride any better.

Some people aren’t allowed on certain roller coasters. Whether it’s for physical or medical issues you just shouldn’t be on that ride. That’s your risk capacity. When we are advising an investment portfolio for you, we talk about if this goes down, will it affect the quality of your lifestyle? And if the answer is yes, then maybe it isn’t for you – there’s a gentler rollercoaster out there.

The Golden Rule of a Roller Coaster

The thing is, once you’re on, you strap in, you keep your arms and legs in, and you hold on tight.

Investing is exactly the same. No matter how scary it feels, you hold on tight.

You trust that the people who run the roller coaster know what they’re doing and have carried out regular maintenance. Think of this like when your financial planner reconfirms your goals, or checks your risk profile, or does the regular due diligence on the funds. We’re carrying out the all-important regular maintenance.

At no point halfway around the rollercoaster do you get to stop the ride and get off. If you do that, it’s probably going to be very unsafe to try and halt that ride and climb down from wherever you are. And again, investing is just like that. No matter how scary it gets, you only get off when you need to – not because you are scared.

Volatility – Measuring how Scary It Could Be

We speak about volatility to describe how much investments move (up & down). It’s pretty much always linked to risk. When things are volatile, you’re probably on a fairly big adrenaline bursting roller coaster. Your fight or flight response might kick in. The best thing you can do? Hold tight and ride it out!

Markets are more volatile right now. There’s no getting away from that. It means markets are going up and down a lot.

For the last few weeks, the daily movements in the market have been by 2 or 3%, rather than what we have become used to and think of as “normal” recently of maybe 0.2 or 0.3% daily movements. But it’s nothing new. Markets have always gone up and down. It’s how they work. Just like the thrill or scare you might get from that rollercoaster.

If you can strap yourself in, and try to enjoy the ride, you should be rewarded.

Real Market Numbers

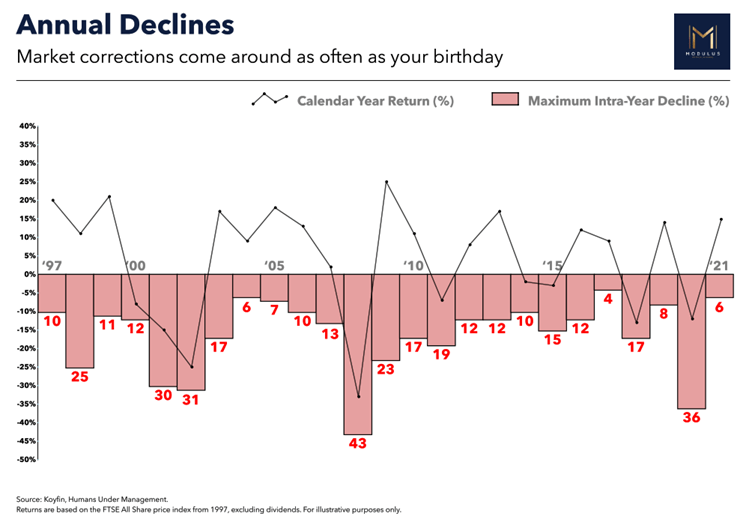

Here’s a graph which shows the calendar year return (black line) of the FTSE All Share every year going back to 1997 and the biggest drop during that year (red bar and number).

Look at 2020, the second last bar. The biggest decline between February and March (when Covid shut down the world) was 36% for the FTSE All Share.

Look at 2020, the second last bar. The biggest decline between February and March (when Covid shut down the world) was 36% for the FTSE All Share.

You can see that almost every year, markets drop by at least 10% at some point every year. In the really volatile years, it can be over 30%. In 2001 it dropped 30%, in 2002 it dropped 31%, and in 2008 it dropped 43%. All pretty scary drops. But it’s normal.

The FTSE All Share year to date (1st January 2022 to 14th March 2022) for 2022, is currently down 6%.

The S&P 500 – the US index – is currently showing a year to date decline of 13%.

The NASDAQ Composite – the US Tech index – is currently showing a year to date decline of 20.5%.

The MSCI World – the index which represents the largest companies across all 23 developed countries – is currently showing a year to date decline of 8.7%

All pretty scary numbers. It’s not comfortable viewing when it’s your own money. But the key takeaway, is the fact that this is all very normal.

Long Term Investing

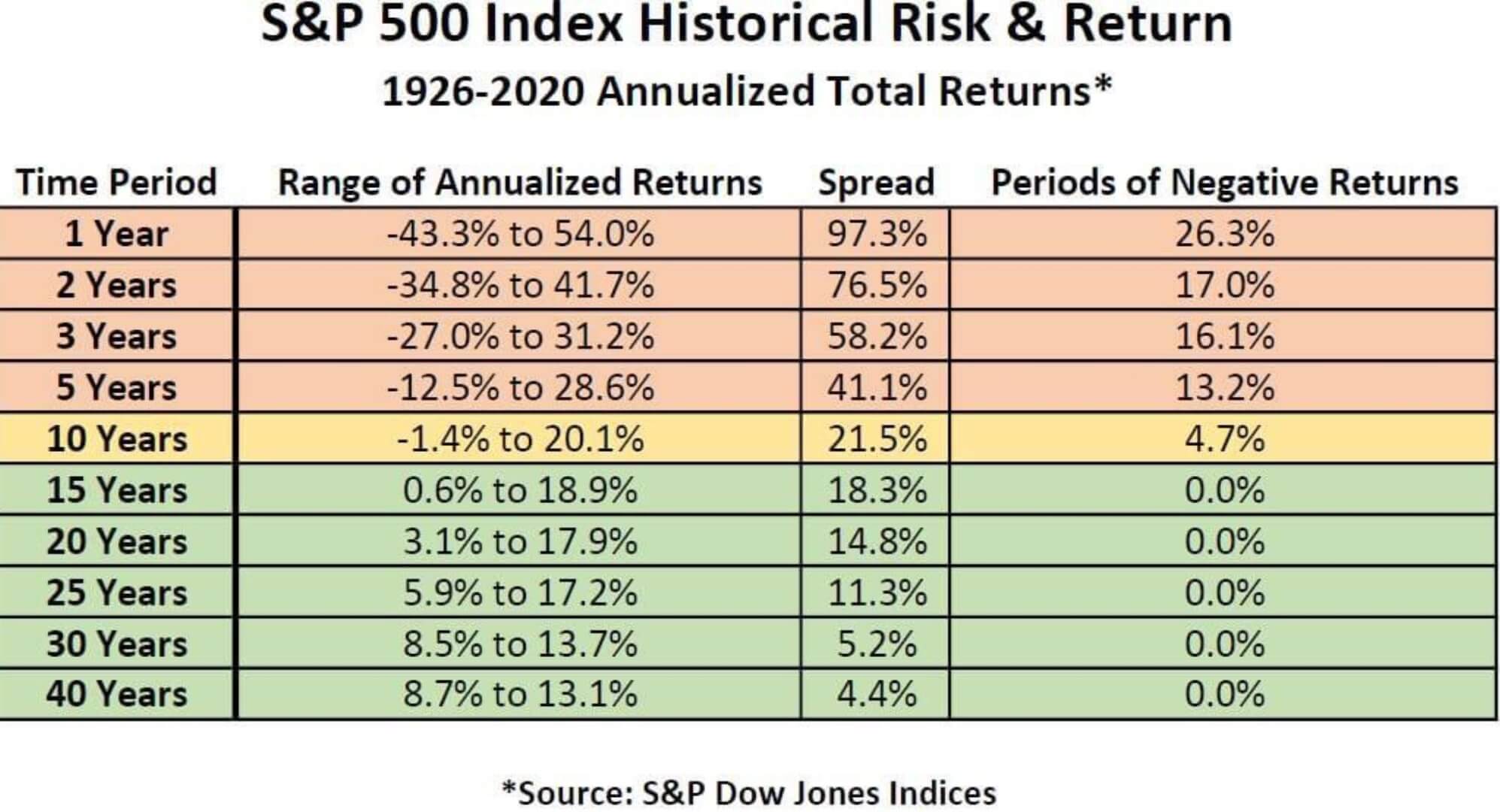

The last snippet of information I want to show is why we talk about long term investing. This is focused on the S&P 500 – the biggest US index.

This shows the importance of investing for a long time.

This shows the importance of investing for a long time.

None of us are investing for one or two years – we are all investing for 10 or 15 years plus. And the key columns here are the Range of Annualised Returns and the Periods of Negative Returns.

This data goes back as far as 1926, almost 100 years. The range of annualised returns over 1 year is a loss of 43.3% at worst, or a gain of 54% at best. That’s some difference. But if we look at a period of 15 years plus (meaning you are invested for at least 15 years) – there is no 15 year period where you lost money.

When holding for more than 10 years, there are periods when being fully invested in the S&P 500 could have lost you money. But it is a very low chance – 4.7% according to this data. That’s why nothing is certain in investing. There will always be a risk, if you want to get a return.

Trust your Roller Coaster Operator

We pretty much never have anyone invested fully in shares. At most, clients might be in what we call a 90% risk portfolio, so there are still some defensive assets. All of these figures are shares/equity only indices. If you think these are scary, take a look at investing in individual shares, or cryptocurrencies and you’ll realise we are still in the family friendly part of the theme park.

So, trust that the time we spent at the beginning of working together helped to select a roller coaster which your stomach can handle. Trust that we have carried out the maintenance and the safety barrier is down. Take a deep breath, hold on tight, and this roller coaster will eventually slow down. We don’t know when, but we do know that it will slow. Eventually. So do your best not to think about all the what ifs, buts or maybes. Hold on and try to enjoy the ride. And if it’s getting scary, talk to us and let’s try to find your happy place until this ride slows down.

*Year to date declines taken from FE Analytics on 14th March 2022

**Past Performance is not a guarantee of future return. Investments can go down as well as up, and you may not get back the full amount you originally invested.