Headline news – the UK is in a recession!

What does this really mean though? Well basically it means that the economy has been shrinking for two quarters in a row. Now if you listen to or read the blurb from some media outlets, you could be forgiven for thinking we are approaching the end of days or something. We aren’t.

What Does Recession Actually Mean?

The UK entering a recession can affect people’s money in different ways, depending on their situation. Here are a couple of simple ways to try and explain what is going on.

- Try to imagine the economy as being a huge cake that can get bigger and smaller. If the cake grows, everyone gets a bigger slice. When the cake shrinks, everyone gets a smaller slice. A recession means the cake has shrunk for two consecutive quarters, or six months.

- Think of your money as water in a bucket with a hole, which is your spending (where have we heard this before). When the economy is going well, you can probably fill your bucket with a bit more water. If there is a bit of a drought e.g. the economy is not going quite as well, then you might have to use some more of the water in your bucket. A recession might mean you might have to use more water than usual from your bucket (or fill it up some other way).

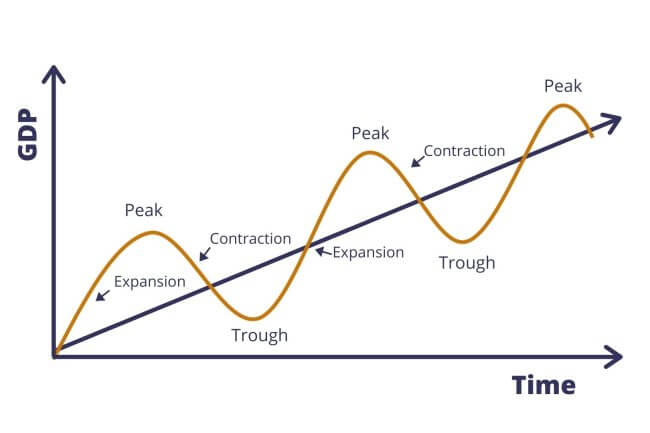

The good news is that recessions don’t last forever. A recession is a natural part of the economic cycle. Que a quick overview of the economic cycle.

Economic Cycles

When the economy grows, people generally have more money to spend and invest – this is called an expansion. This invariably hits a natural peak (as nothing can rise forever) and the expansion ends. The economy will then shrink and contract, and people generally have less money to spend and invest – this is called a contraction or a recession. The contraction ends when the economy reaches a natural trough, which is its lowest level and then the recovery starts. And so, the process starts again with growth and so forth. This is the cycle that economies work on. Nothing can go on forever – either up or down.

Please note that this is only a brief bit of information about what a recession actually is. It isn’t for me to go into great detail about the causes of recession or the ways governments can try to mitigate their impact in the long term (way above my paygrade). I also understand that recessions can have devastating impacts for many people in terms of their livelihoods and family circumstances.

How Does A Recession Impact My Investments?

The thing to remember is that recession isn’t here for the long term, unlike investments. If the markets are spooked by the news of a recession, then the big thing is to not panic. Would you sell your house because someone has said that it is worth slightly less this week than it was last week? If the answer is no then why would you consider selling your investments when the market is in a temporary decline.

“In the short run, the market is a voting machine but in the long run, it is a weighing machine” – Benjamin Graham (the famous investor who was a mentor to Warren Buffet)

What we need to remember is that in the short term the markets can be affected by people being people. This can mean people act irrationally out of fear, the unknown and by listening to all the doom and gloom merchants in the media (this helps drive volatility – the way the stock market moves up and down). In the long term though markets are like a weighing machine which measure the value and output of the great companies of the world (think long term – Apple and Microsoft weren’t always the biggest companies in the world).

If news of this latest recession does lead to a temporary decline in the markets, then try to think of this as an opportunity. It is potentially a chance to buy more shares / units in the great companies of the world at a lower price (a short-term sale if you will). A well-diversified portfolio, with holdings across different asset classes, sectors and regions all help to reduce risk in the long term. For the portfolios we advise on, UK stocks make up a very small part of the portfolio (as evidence shows that the UK is only a small part of the global stock market – but we will come back to that another time!).

Always remember that investing is a long-term game, and that markets will tend to recover over time.

Note – I deserve a medal for not making the obvious bucket and well pun!

Please note that this blog is for information purposes only. Past performance is not a guarantee of future returns. Investments can go down as well as up, and you may not get back the full amount you invest. Please seek professional advice before making any investment decisions.

*Image sourced from – https://secrethomes.ca/understanding-economic-cycles-part-i/