“Please don’t check your investments every day”

This is something we tell every client when they first sign up. And it’s something worth repeating.

We know just saying this won’t change your behaviours. But hear us out.

Your investments will change every day. No question about that. And it can scare the life out of you if it seems to go down “too often” or by “too much.” At the same time, you might want to celebrate and retire tomorrow if you’ve had a few weeks of positives and only going up.

This is the disadvantage of online access and up to the minute information. By the way, our platforms only update once a day, so there’s no point logging in more than once a day

The house you own, your car, the prized painting on the wall would likely change in price if you valued it every day too. It’s simple supply vs demand economics. But we don’t value them every day. And so, they all seem less volatile, and therefore feel less risky.

Investment Risk vs Investment Volatility

What is at play here is Investment Volatility vs Investment Risk. They are linked, but they are different.

If you are investing your money for the long term, you need to understand these two important concepts: risk and volatility.

Risk is the possibility that you will lose some or all of your money.

Volatility is the amount of fluctuation of the value of your investments over time. In simple terms “How far up or down they go.”

Both risk and volatility can affect your returns, but they are not the same thing.

So what does that mean?

Risk is related to the quality of your investments. For example, if you invest in a small start-up company that goes bankrupt, you will lose your money. That is a high-risk investment. On the other hand, if you invest in a bank account which guarantees an interest rate, with the FSCS guarantee that you will get your initial sum (up to £85k) back, that is a low-risk investment.

Overall Risk can be reduced by diversifying your portfolio, which means spreading your money across different types of investments, sectors and countries. The old saying of “Don’t put all your eggs in one basket.”

Volatility, on the other hand, is related to how much your investments move up and down in price. For example, if you invest in the stock market, you will see the value of your portfolio go up and down every day, depending on the supply and demand of the shares. That is a high-volatility investment. If you purchase bonds (or fixed interest), where a government or company agrees to pay you a rate of return, and then return your initial investment at the end of the term, this should be a lower volatility investment.

This is normally the case, except for extreme time periods like September 2022. Interest Rates rapidly increased which, in turn, decreased the value of the agreed fixed interest rate.

Think of volatility like the comparison between a roller coaster and a gentle train ride.

Volatility can be reduced by investing for the long term, which means holding on to your investments and ignoring the short-term fluctuations.

The Key to Long Term Success

Why is it important to know the difference between risk and volatility? Because it can help you make better decisions and avoid emotional reactions.

The biggest long term risk to you is inflation. By flocking to cash bank accounts, you can lock in short term decent returns relative to what cash paid 2 years ago. However, cash won’t beat inflation in the long term. (Or at least it shouldn’t because it is used as a measure of control over inflation).

Locking in 5% today could turn out to be a savvy move in 12 months’ time. But if markets rebound and do a double-digit return, you could feel very silly. Nobody knows what will happen or when.

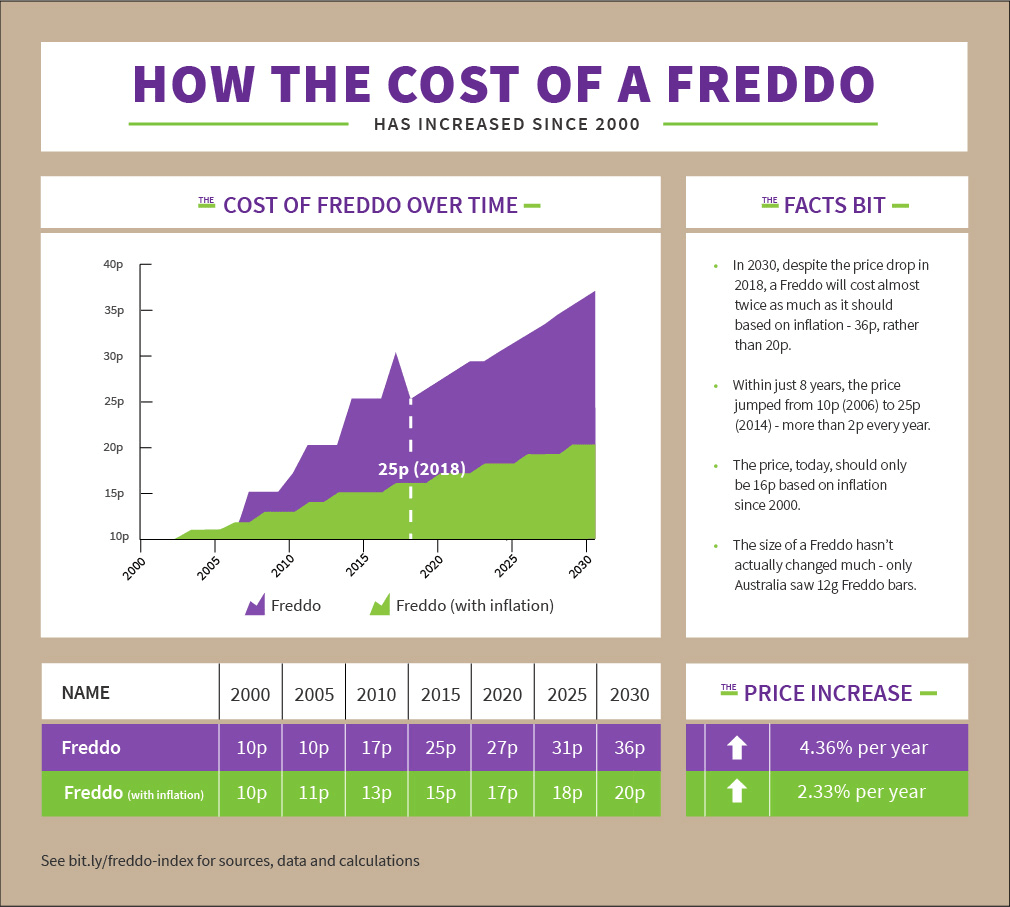

Yes, cash still has a place, and arguably a more sizeable chunk of your money could be kept in cash for now (depending on your personal circumstances), but never all of it. The only thing worse than not enough cash, is too much cash. Because you have locked in that loss to inflation, and so what the money could buy you today, there is no chance it will buy you the same in 5 years’ time. Think of the mighty Freddo Bar for example.

Stop Checking Your Account Every Day

If you check your investment account every day, you will see a lot of volatility, which can cause anxiety or excitement. You might be tempted to sell when the market is down or buy when the market is up, which can hurt your returns in the long run. When has it ever been a good idea to sell low and buy high?

If you check your investment account less frequently, say once a year or even twice, you will see less volatility and more of the overall trend, which can help make you feel more confident and calm. You might be more likely to stick to your plan and achieve your goals. We always say, the best portfolio for you is the one you will stick to.

There is often talk about a study completed by Fidelity which showed that two types of investment account owner beat everyone else in the years from 2003 – 2013. Dead Account Owners, and those who had lost their passwords.

I’m struggling to find the original post, but enough has been written about it from a quick Google search of “Fidelity study dead investors”

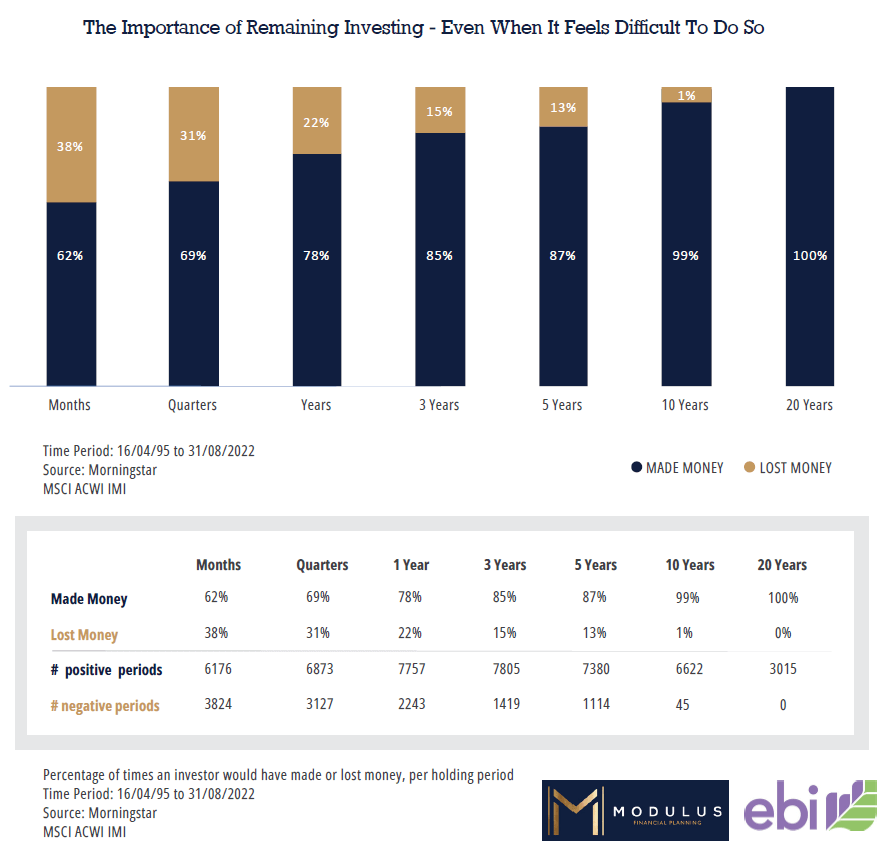

The below shows how often you made money or lost money over the long term. The longer the time horizon, the more likely it is you make money.

Trust The Process

Remember, risk and volatility are part of investing, and they both offer rewards. Risk should give you the potential to earn higher returns than safer investments, and volatility allows you to buy low and sell high. Your biggest risk of all is thinking that holding everything in cash is risk-free. Because inflation will win.

The key is to understand the differences, manage it, and most importantly use the information to your advantage.

We make the investment decisions based on all the evidence and data we have available. We have our own money in the same investments our clients do. And so, we feel it just as much as you do.

One thing we can offer, is we’ve been going through times like this with clients now for 10-15 years. It’s never easy when you see money go down. But trust in the process, forget the short-term fluctuations and focus on the long term, and it will work itself out.