We haven’t rushed out this blog to start shouting from the streets about the changes, because frankly, I’m struggling to get excited about any of it. I personally would have liked to see an end to frozen tax brackets, or even a suggestion that something might increase soon. With the freezes, we all pay more tax (assuming pay increases) and so, I was torn in even writing anything here.

But here’s some of the more relevant announcements.

National Insurance Rates Cut Again

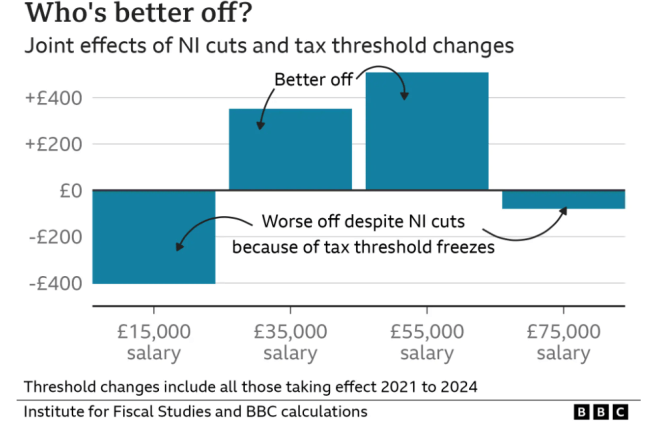

The National Insurance rate will be reduced by 2p for employees and self-employed individuals, potentially saving the average worker around £450 per year. However, if you are on a low salary or a salary over £60k, according to the BBC, you are worse off due to the tax thresholds being frozen/reduced since 2021.

I find it hard to get excited about this, but every little helps I guess.

The British ISA

A brand spanking new, British ISA (another acronym coming in – BISA), with an additional allowance of £5,000 will supposedly be introduced, and it can only be invested in UK companies. Who says the Government can’t force us into potentially negative outcomes?

If you invest your entire £5k new allowance, to maintain a global asset allocation in your ISA, you would need a further £137k in your ISA in a global portfolio (excluding UK) just to maintain global diversification. This is because the UK makes up just 3.5% of World Equity Markets.

And that’s only for one year, just wait until you top it up for your second year’s contributions.

Good old Sunak and Hunt are doing everything to undo our work of not having a UK home bias.

In reality though, will this new BISA even happen? Who knows. Look at the uptake of the Lifetime ISA – there are still very few providers who support it.

But it does mean for anyone with a Lifetime ISA, they would be able to invest up to £26,000 per annum tax free. (£5k in a British ISA, £16k in a Stocks & Shares ISA, £4k into your Lifetime ISA and also add on the £1,000 Government Bonus)

Add to the fact the number of people who actually use their full ISA allowance as it is, and I’m not sure how much impact this will really have.

Good News for Child Benefits

This is probably the only thing that piqued my interest. Child benefit will now be paid in full to households where the highest earner earns up to £60,000 instead of £50,000, with partial benefits available for households where the highest earner earns up to £80,000.

The taper will now be at 0.5% for every £100 earned over £60,000. For example, if you earn £65k, you would be entitled to 75% of full child benefit.

There will also be a review and, hopefully, future change to consider household income rather than the highest earner. I would also imagine the household income threshold will be greater. I would hope this would be increased to something more like the “tax free childcare help” threshold of £100k, but don’t get me started on that misnomer.

This will be great for higher earning single parents, or those couples where one might work part time, or not at all to look after children.

No Change to Alcohol Duty

Quick, grab yourself a cold drink. The freeze on all alcohol duty will continue until August 1st 2025.

Bad news for Smokers

The duty rate on tobacco products is set to rise by 2% above the Retail Price Index (RPI) inflation, with hand-rolling tobacco facing a steeper increase of 12% above RPI.

Chancellor Jeremy Hunt announced a new tax on vapes to discourage smoking alternatives, making them unaffordable for children. This levy will be implemented from October 2026 and will apply to the liquid in vapes, with higher taxes for products containing more nicotine.

Non Dom Tax Rules

New rules for non-domiciled individuals (non-doms) will be introduced from April 2025. The proposal will mean if you have lived in the UK for 3 years or more, you will begin to pay UK tax on non-UK income and gains.

Pensions

Thankfully pensions were left alone. However, there is a review into potential changes where employees may have the power to choose where their contributions go. This would remove the possibility of losing track of small pots and apparently “it has the potential to unlock additional retirement income for savers.”

The Government are doing this to see if an approach (like the one in Australia) is possible, where one pension which follows you, and any employer you have pays into it. At present, this is only a review and consultation, and is a long way from fruition.

So that’s basically it. Again, I don’t think there’s anything there to be getting particularly excited about, but feel free to call me a cynic.