Have you ever been stuck in traffic on a motorway? I can’t imagine that many of us living in Northern Ireland haven’t been stuck in traffic on the way to Belfast for what seems like an eternity!

You can be sitting there and slowly moving on, when suddenly you see a gap in the next lane that looks like it could save you a few precious seconds. You quickly change lanes, hoping to get ahead of the pack. And as soon as you switch you see that the lane you just left begins to move faster than the one you’ve just switched to. You feel a pang of regret and frustration. You wonder if you made a mistake. You look for another opportunity to switch back, or maybe to a different lane altogether.

Does this sound familiar? Well, if you’re an investor, you might have experienced something similar with your portfolio. You could have heard of a hot fund that just had a stellar year. You make the switch, you pay the new fee and you’re on the bandwagon. You’re optimistic and know that you’re going to ride the wave of success. But then, what happens? The fund / investment you just sold starts performing better than the one you bought. You feel a pang of regret and frustration. You wonder if you made a mistake. You look for another opportunity to switch back, or maybe to a different one altogether.

So the question has to be – why do we put ourselves through this? Well in short it is because we are human, and it is embedded into our behaviour. There are however more scientific explanations, psychological factors, that influence our decision making, such as:

– Recency bias: We tend to give more weight to recent events and trends than to historical ones. We think that what’s happening now will continue to happen in the future, even if it’s not supported by evidence or logic. Think of how the news and media influences this every day. You will often hear about “Billions wiped off the stock market” but you never see the headline “Billions added on the stock market”. Bad news sells.

– Fear of missing out (FOMO): We don’t want to be left behind by others who seem to be doing better than us. Joe down the pub told you he is invested in the latest fad and says you should be as well. We feel pressured to join the crowd and follow the herd, even if it means going against our own judgment or strategy. Just like seeing that car in the next lane pull away, some people can’t bear to miss out on those perceived valuable seconds and may make a rash switch to avoid this.

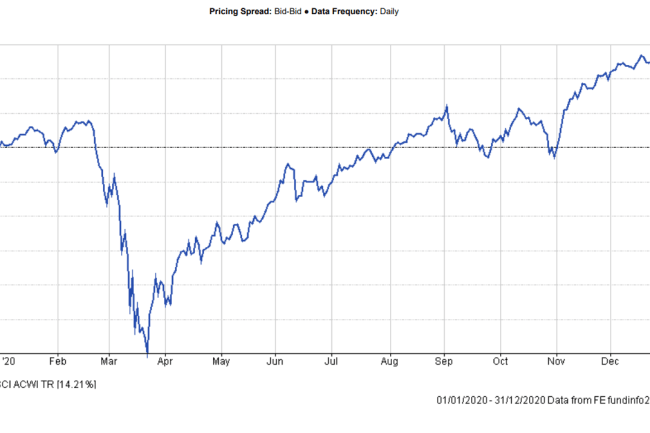

– Overconfidence: Quite often we think we know more than we do. We underestimate the risks and uncertainties involved. For instance, we may think that we can anticipate the traffic flow and switch lanes at the right moment, or that we can react faster and safer than others. Similarly with investing, we may think that we can time the market and buy low and sell high, even though it’s been proved that is impossible to do so consistently. Can you remember what happened after the first Covid lockdown was announced? Markets went into meltdown. Advice was being doled out by Joe (down the pub before it closed) and even some advisers to cash out now. Many moved their invested money into cash. And what happened – the markets went off on a tear. Global markets, despite an almost 30% drop recovered to finish up over 14% for the year. If someone cashed out at a loss and then bought back in when markets “were good again”, then they essentially sold cheap and bought expensive (a real way to destroy wealth quickly!).

Data shows the MSCI ACWI Index for the 2020 Calendar year. Taken from FE Fund Info.

– Loss aversion: We hate losing more than we love winning. We hold on to losing investments for too long, hoping they will recover, and we sell winning investments too soon, fearing they will drop. Loss aversion is the tendency to prefer avoiding losses over acquiring gains. It means that we feel more pain from losing something than pleasure from gaining something of equal value. For example, losing £100 feels worse than gaining £100. It is like when you are in your car and you start falling behind the cars in the other lane. You don’t feel like you are moving forward when you know that you are. It seems like the other lane is going faster than you and you are missing out.

These are just some of the cognitive biases that can affect our decision making and lead us to making some poor choices – both in investing and driving. They can make us act like impatient drivers who stress, chase cars and switch lanes every few seconds, increasing traffic congestion and possibly causing accidents. It is the same for investing – where we could end up stressing, switching investments too often, chasing performance and paying unnecessary fees (and possibly taxes).

The result is likely to be the same, a bad driving / investment experience over the course of the journey.

They key is patience, both on the road and when investing. Sit back and remain calm and rational. At times this can be easier said than done so here are some tips to help:

– Plan your journey in plenty of time and leave early!

You might not know exactly where you want to go to, but you will have a good idea of the general direction. The earlier you start the journey then the less stress there will be when you are in traffic (or something happens). You need to know why you are investing (or driving), and what you want to achieve. Stick to your plan unless there is a significant change in circumstances (like a major life event or road closure). Your journey can change a lot over a long distance, so it is important to check the map and maybe alter the route every so often. Use your financial planner / a good Sat Nav system!

– Diversify

Don’t put all your eggs in one basket or all your wheels in one lane. Spread your investments across different asset classes and sectors. Just like driving, sometimes it might be useful to use different routes or modes of transportation (you can’t drive all the way to Spain unless you’ve invested some type of submarine car). Diversifying means you can reduce your exposure to specific risks and benefit from different opportunities (tax planning, time saving etc).

– Ignore the noise

Don’t let the car beside you who is blaring their horn influence your journey. Likewise, don’t let the media, short term market fluctuations or other people influence your decisions (Joe down the pub is the worst for this). Others are often driven by emotions, opinions, or agendas that may not align with yours. Focus on your journey, your plan and trust it.

– Be disciplined and patient

Don’t let emotions get the better of you. Don’t chase perceived short-term gains. Don’t react to every market movement or traffic jam. Focus on the long-term outcomes and the big picture. Saving a few seconds on a 12-hour journey is hardly worth paying additional costs and possibly causing some long-term damage by taking unnecessary risks!

So next time you’re tempted to change lanes or investments, ask yourself: Is this really worth it? Am I making a rational decision based on my plan and goals? Or am I just following my emotions and impulses? If you’re not sure, maybe it’s better to stay where you are and enjoy the ride. You might find that you’ll reach your destination faster and happier than those who keep switching and stressing.

Eventually you’ll become the person who sits back (in your own lane) and marvels at those who believe they can outsmart traffic. You’ll be the person who can relax and watch, as others start cutting up traffic and wasting fuel whilst getting increasingly stressed.

Please note that this blog is for information purposes only. Past performance is not a guarantee of future returns. Investments can go down as well as up, and you may not get back the full amount you invest. Please seek professional advice before making any investment decisions.