Trying to time the stock market can lead to missed opportunities

Market timing is an investment strategy that aims to buy and sell investments to maximise returns. However, it is not always a wise investment choice.

The main problem with market timing is that it is extremely difficult to execute consistently. To successfully time the market, you have to be right twice.

- You need to choose the best time to sell, and

- You have to identify the optimal time to re-enter the market.

The issue is that an error in timing entry and exit points can be very costly for investors. This is because the best market days often occur during the most challenging downturns, and missing even a single day can have dramatic consequences for long-term capital value.

A Recent Study – the facts

Numerous studies have demonstrated that time in the market beats timing the market.

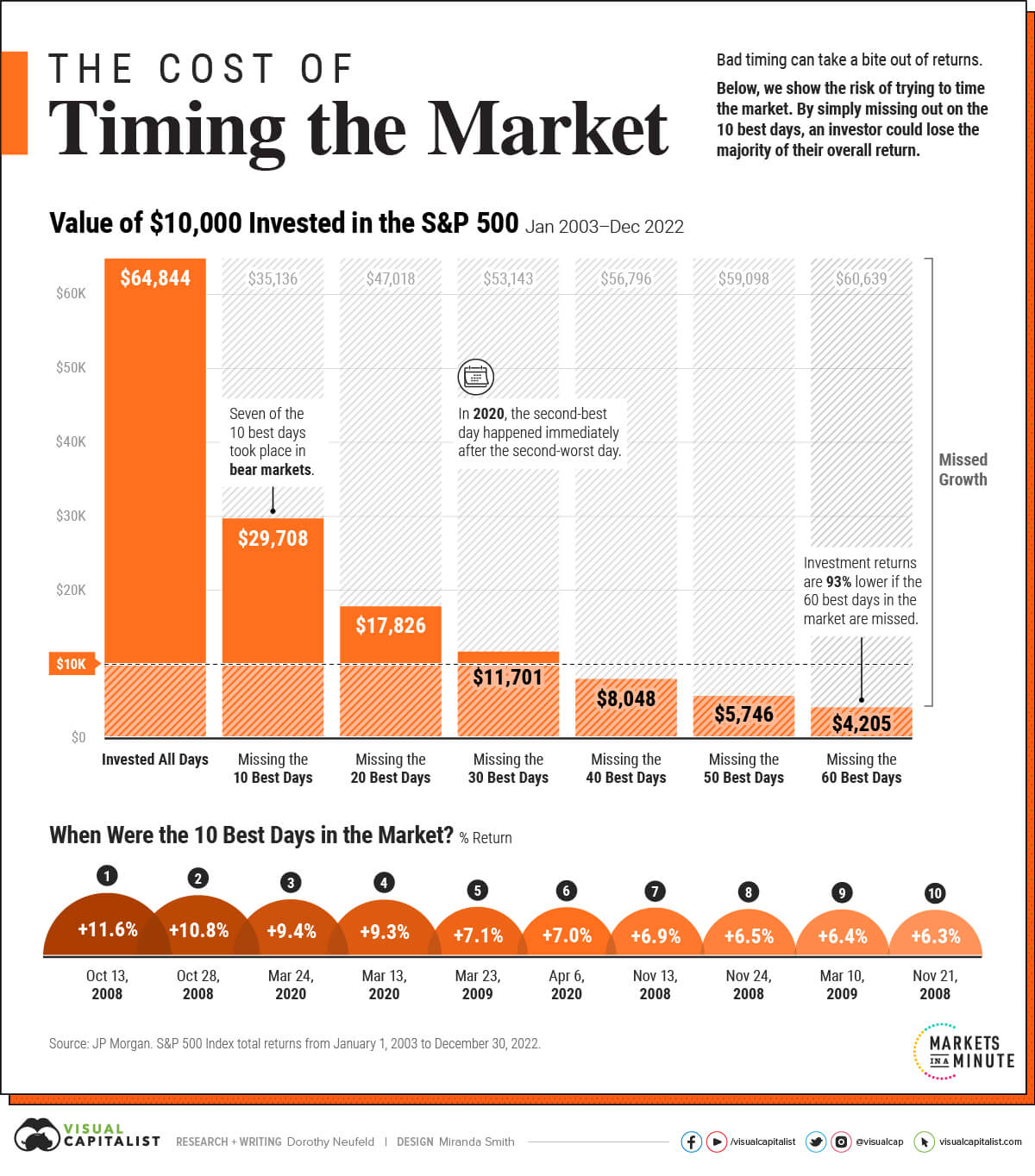

Last year, as illustrated by Visual Capitalist, a JP Morgan study concluded that even missing just a handful of the best market days can significantly reduce an investor’s average returns over time. The chart shows the 10-year performance of the S&P 500 stock index as of December 30, 2022.

As you can see, $10,000 invested in the S&P on 1st January 2003 for ten years, returned $64,844 in 30th December 2022. Safe to say, that’s quite attractive.

But what would happen if you missed the 10 best days within those 10 years? The return dropped to $29,708. That’s quite a difference for missing just 10 days in over 10 years.

Look when the best 10 days happened. During 2008-09 (The Recession) and March 2020, immediately after the first Covid lockdown market collapse. During both of these time periods, you could have been forgiven for panicking when you saw your investment values. But if you held on, you were definitely rewarded.

And what if you missed the best 30 market days in 10 years? Your return would decline to just $11,701. This would mean sacrificing almost all of the return on your $10,000 over 10 years. This is the risk of market timing.

Another issue with this is that it drives up costs. Every time you deal in the stock market, there is a transaction charge.

So What Can We Do About it?

When we’re talking to clients, particularly business owners paying into their pension, we generally prefer they make a monthly contribution with a view to a larger one off contribution towards the end of their business year. This helps with two things.

Firstly, Cashflow. How often do we say we’re going to do a big contribution to get to the end of the year and there’s not much cash left in the bank?

But secondly, it largely reduces the effects of market timing because you have been contributing monthly. This is called Pound Cost Averaging (or Dollar Cost Averaging if you follow American articles).

Therefore, we encourage our clients to avoid market timing and instead adopt a buy-and-hold strategy.

Buy and hold is known as a passive investment strategy in which an investor buys investments and holds them for a long period regardless of fluctuations in the market. An investor who uses a buy-and-hold strategy actively selects investments but has no concern for short-term price movements and technical indicators. Many legendary investors such as Warren Buffett and Jack Bogle praise the buy-and-hold approach as ideal for individuals seeking healthy long-term returns.

If you have any questions or would like to learn more about our investment strategies, please do not hesitate to contact us.

*Investments can go down as well as up, and you may not get back the full amount you invest.

**Past performance is not a guide to future returns