As of April 2023, the government increased UK Corporation Tax rates for limited companies. Having been at a flat rate of 19% on company profits, it is now effectively a banded tax rate. The effective rates are now:

| Profit Band | Marginal Rate |

| £0 to £50,000 | 19% |

| £50,000 to £249,000 | 26.5% |

| £250,000 plus | 25% |

As with all things tax, there is a much more complicated calculation and so the above table gives a headline guide rate. The official calculation is to tax all profits at the flat rate of 25% and then apply the Marginal Small Companies Relief (MSCR) but that’s much too complicated for this.

For example, a company with profits of £100k would have had a Corporation Tax bill of £19,000 before these changes. Now it is calculated as:

£50,000 x 18% = £ 9,500

£50,000 x 26.5% = £13,250

Corporation Tax Due = £22,750

This gives an effective rate of Corporation Tax of 22.5% on all profits.

Here’s a summary of tax due on profits between £50,000 and £250,000.

| Total Profits | £50,000 | £100,000 | £150,000 | £200,000 | £250,000 |

| First £50k at 19% | £9,500 | £9,500 | £9,500 | £9,500 | £9,500 |

| Remainder at 26.5% | £0.00 | £13,250.00 | £26,500.00 | £39,750.00 | £53,000.00 |

| Total Corporation Tax Due | £9,500.00 | £22,750.00 | £36,000.00 | £49,250.00 | £62,500.00 |

| Effective Rate on Total Profits | 19.00% | 22.75% | 24.00% | 24.63% | 25.00% |

As profits increase, the effective rate of overall Corporation Tax increases until profits of £250,000+ where the rate is 25%.

In summary, this means that many companies will face higher Corporation Tax bills.

Combine this with the reduction of the dividend allowance, the freezing of the personal allowance and reduction of the capital gains tax allowance, and it doesn’t look just as appetising to be a business owner.

So What Can You Do About It?

There are two main things to consider when planning your personal and business finances.

- Your income Strategy – is a small salary and a large dividend still the best option?

- Pension Contributions – Make an employer pension contribution

Let’s look at both in a bit more detail.

1. Your Income Strategy

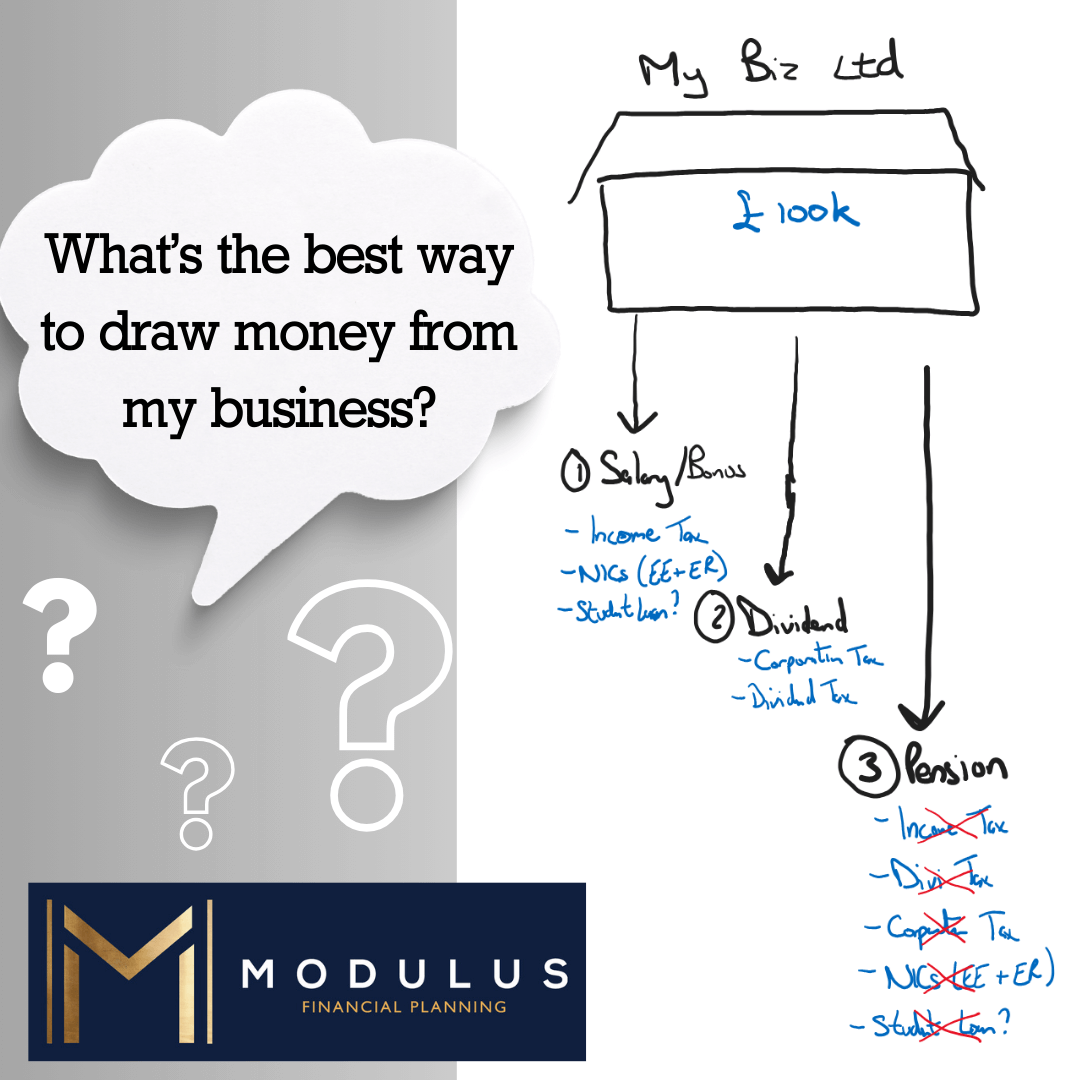

The first thing to remember here is the order of taxation. By that I mean the company pays Corporation Tax before it can pay out dividends on the after-tax profits. Whereas, salary or a one off bonus is paid by the company before it pays Corporation Tax and is therefore an allowable expense.

So all you need to remember is that salary/bonus comes off the bottom line for calculating Corporation Tax, whereas for dividends, you must calculate Corporation Tax first and then declare dividends from what remains.

This is where you must speak to your accountant to agree what’s best for you and your own situation, as there are many differences to be wary of. But let’s look at a simplified example.

Your single director and shareholder company has profits of £100k and a potential subsequent Corporation Tax bill of £22,750. This means that after tax, the company could pay a dividend of up to £77,250.

Remember Dividends are personally taxed at 8.25% for Basic Rate Tax and 33.75% for higher rate tax payers.

Assuming you have used your full personal allowance with a small salary of £12,570 per annum, that means your annual dividends would work out as

Tax Due

£1,000 of Dividend Allowance @ 0% £0

£36,700 at Basic Rate Dividend Tax @ 8.25% £3,027

£39,550 at Higher Rate Dividend Tax @ 33.75% £13,348

Total Dividend Tax due £16,375

This means that your annual profits of £100k allowed you a dividend of £77,250, which was worth £60,875 in your pocket after Dividend Tax (which is payable through Self Assessment in January of the following tax year – so make sure to save the amount due for tax).

If you took the same £100,000 as salary, you would wipe out the company profits, and so too the Corporation Tax bill. However, you must remember that there is the complication of National Insurance Tax on both the Employer and Employee. All tax would be taken through PAYE.

This calculation becomes very complicated and so here’s a link to the UK Tax Calculators website which does it for you – https://www.uktaxcalculators.co.uk/tax-calculators/business-tax-calculators/dividend-vs-salary-result/

The end result is that if it’s taken as Dividend, you pay 33.09% tax in total (across both corporation and dividend tax) whereas if it’s taken as salary of £88,976 (due to Employers NIC bringing the cost to £100k) the total tax paid is 39.34%.

And so in this example, a dividend is still better for the sole director and shareholder, but not by as much as it used to be.

There are of course many considerations to think of which will change this, such as Student Loan repayments, Pension contributions on salary, P11D benefits and/or car allowance etc.

The other thing to consider is if you are applying for a mortgage in the near future as you need a track record for dividends to be considered.

This is why it’s so complicated and must be discussed with your accountant as well as your financial planner.

2. Employer’s Pension Contribution

Your company can pay an employer’s pension contribution into your pension and it is normally an allowable expense for Corporation Tax purposes.

For example, for the same company with £100k of profits, you could use your full annual allowance for this tax year of £60k. This would bring company profits down to £40k, reducing your Corporation Tax bill from £22,750 to just (£40,000 * 19% =) £7,600.

This would then leave £32,400 (£100,000 – £60,000 – £7,600) which could be paid to you as a dividend as above.

Assuming you had only taken a small salary of £12,570, your additional benefit would therefore be £60k into a pension and a net dividend of £28,731 which means of your £100k profits, you received £88,731 and only £11,269 went to Corporation Tax and Dividend tax.

Don’t Forget About Pension Carry Forward

Depending on how much you have contributed to your pension in the three previous tax years, you might be able to pay even more than your £60k allowance into your pension.

The maximum pension contribution you could pay is £180,000 (this year’s full annual allowance of £60k and the three previous annual allowances of £40k per annum) which in the case of this example would be more than the company’s £100k profits.

Of course, if cash is available you may decide to post an artificial loss if your accountant agrees. Alternatively, you simply use up this year’s total profit and then do the same next year if your company is likely to have similar (or greater) profits next year.

Even if you don’t pay the full allowance available, it is worthwhile to pay contributions to bring profits back below £50k to make sure your company only pays 19% on Corporation Tax rather than 26.5% on any profits over £50k.

This has been a technical blog and I know not everyone enjoys a tax calculation as much as me…. but the overall thing to take away is that there are still things you can do, but planning ahead with your financial planner and accountant is more important than ever.

At the end of the day, we want you to live the life you want, so we must maximise both your tax saving but also your take home pay to let you enjoy the lifestyle you want.

The correct answer will likely be a combination of pension and take home pay (whether that is dividend or bonus).

If you want to discuss anything about this blog or your own personal situation, please feel free to call or email us, or if you’d prefer a more structured conversation then book yourself into our diary.