As some of you know, I actually did a Finance degree before starting out in financial planning. Oddly enough, it seems to be quite rare to meet a financial planner who has a degree in anything remotely financial. Most I meet seem to have a degree in Geography, History or Politics.

In hindsight, I think I know why. Very little of my degree was of any relevance to Financial Planning or Personal Finance. We had to know about the relevant models of portfolio theory, the equations for pricing stocks and bonds and knowing “when to get in” and “when to get out” of the market. It was very focussed on becoming a trader or going into investment banking. At no point were the words pension, ISA or even tax year mentioned. After 4 years at university, I still didn’t have a clue about any of that.

But something we had to look at in a project was the phenomenon known as “The January Effect” in investment markets.

The Theory

The “January Effect” is a theory in investing that suggests that the stock market tends to rise during the month of January. According to this theory, the market experiences a seasonal boost in trading activity and stock prices during the first month of the year, and this is thought to be due to a variety of factors, including portfolio rebalancing and investor optimism.

One reason for the January Effect is portfolio rebalancing. Many investors will adjust their portfolios at the beginning of the year, buying or selling to realign their holdings with their risk profile and investment objectives. Those who don’t believe in timing the market pick a date in the year, often January, because it’s a good time to review your finances.

Finally, investor optimism may also contribute to the January Effect. At the beginning of the year, investors are often filled with hope and optimism about the future, which can translate into a rising market. This can create a self-fulfilling prophecy, as investors start buying stocks, causing prices to rise, which then encourages more buying.

Does It Exist?

Despite the widespread belief in the January Effect, there is debate among financial experts about whether it actually exists. Some studies have found that there is indeed a seasonal pattern to stock market returns, with January being a particularly strong month. Other studies, however, have failed to find any evidence of the January Effect, and some experts argue that any seasonal patterns in the market are simply the result of statistical noise.

There have been several studies conducted on the January Effect, but the results have been mixed. Some studies have found statistical evidence to support the theory, while others have not.

In our study, we found no consistent evidence of it – I think January was a good investing month in 1 of every 3 years. We found more evidence of an April effect. We couldn’t think of any reason for it, but knowing now that there is a tax year, perhaps it holds for the same reasons? Rebalancing portfolios, contributing to ISAs and Pensions and feeling good about the upcoming year. Who knows?

January 2023

This January, investment markets rose. It could be because of the January Effect, it could be a bounce because 2022 wasn’t so good, it could be optimism, it could be declining inflation, it could be interest rates nearing a peak, it could be down to anything. It could even be all of the above.

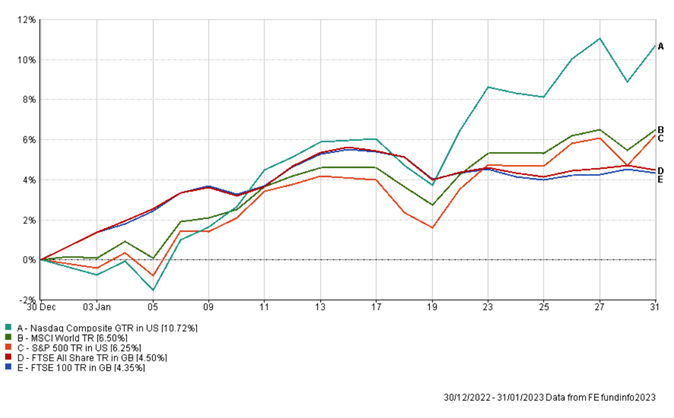

As you can see, the UK (FTSE 100 and FTSE All Share), the USA (S&P 500 and Nasdaq Composite) and the world market as a whole (MSCI World) all had a pretty good month in January.

Will it continue? Who knows. Why did it happen? For a variety of reasons.

The key is, if you’re still invested, you will have benefitted from this. If you’re trying to time the market and wait for a “good time to get in” I hope you got it right.

Avoid the Theories

Regardless of whether the January Effect is real or not, it is important for investors to remember that trying to time the market based on seasonal patterns is generally not a wise strategy. The stock market is notoriously difficult to predict, and even if the January Effect does sometimes exist, there is no guarantee that it will happen every year or that it will continue in the future.

Instead of trying to time the market, investors should focus on building a well-diversified portfolio and holding onto them for the long term. By doing so, investors can reduce their risk and potentially achieve solid long-term returns, regardless of short-term market fluctuations.

As ever, if you want to discuss anything about this, please do give myself or John a shout.

Investment Markets can go down as well as up, and you may not get back the full amount you originally invest.