Given what is happening in the world right now, specifically in the UK, we felt it a good time to drop a few words with our thoughts.

One thing you won’t hear from us is a prediction. We do have some opinions, (in fact at times we can be very opinionated – especially about car parking) but we won’t ever make a prediction on the markets or indeed the economy in general. This is because the markets are not something that anyone can predict with any certainty. Indeed, some economists will make some sweeping statements about what they think will happen with markets and the economy. If they get this wrong (and they often do), then they aren’t really held to account. They are a bit like the weatherman in that they are one of the only groups of people who can be wrong regularly and keep their jobs! I am joking here of course because much like the weather, the economy and the markets are in constant flux, they constantly change. Predicting what will happen next is often an educated guess, but it is a guess nonetheless because no one really knows what will happen.

Look at what happened recently with the ill-fated mini budget (23rd September 2022). The day after the Bank of England raised interest rates to 2.25%.

Kwasi Kwarteng (or Kami Kwasi as the papers apparently call him – I learned that at a quiz last week), made some sweeping announcements about plans to cut tax in the UK. This was pretty much unprecedented and the reaction to this was staggering.

- GBP fell dramatically against the Euro and the Dollar (but there has been some recovery since then)

- The FTSE 100 also fell, continuing this trend through for almost a week before making some gains

- The Bank of England stepped in to try and stabilise markets

- Lenders started pulling mortgage deals to new borrowers

- Some fixed term mortgage rates went as high as 6% for 2-year deals

- Mr Kwarteng then announced a U turn on his plan to abolish the 45% rate of income tax (due to internal pressures within his own party!)

- On 10th October, he declared that he is bringing forward his plan for rebalancing the government’s finances (how he plans to fund the £43Bn of tax cuts) from 23rd November to 31st October (in a bid to try and stabilise markets & before the next review of Interest Rates on 3rd November)

Phew! That is a lot of information to process in a very short space of time, in a small country like the UK. There is a lot going on in the world right now, with a great deal of uncertainty. And that will always be the case. There is always something going on that will make it less attractive to invest or indeed to remain invested. It’s OK to be nervous. What we will always say is that there will always be something. In recent times – Covid, the invasion of Ukraine and the UK economy to name a few.

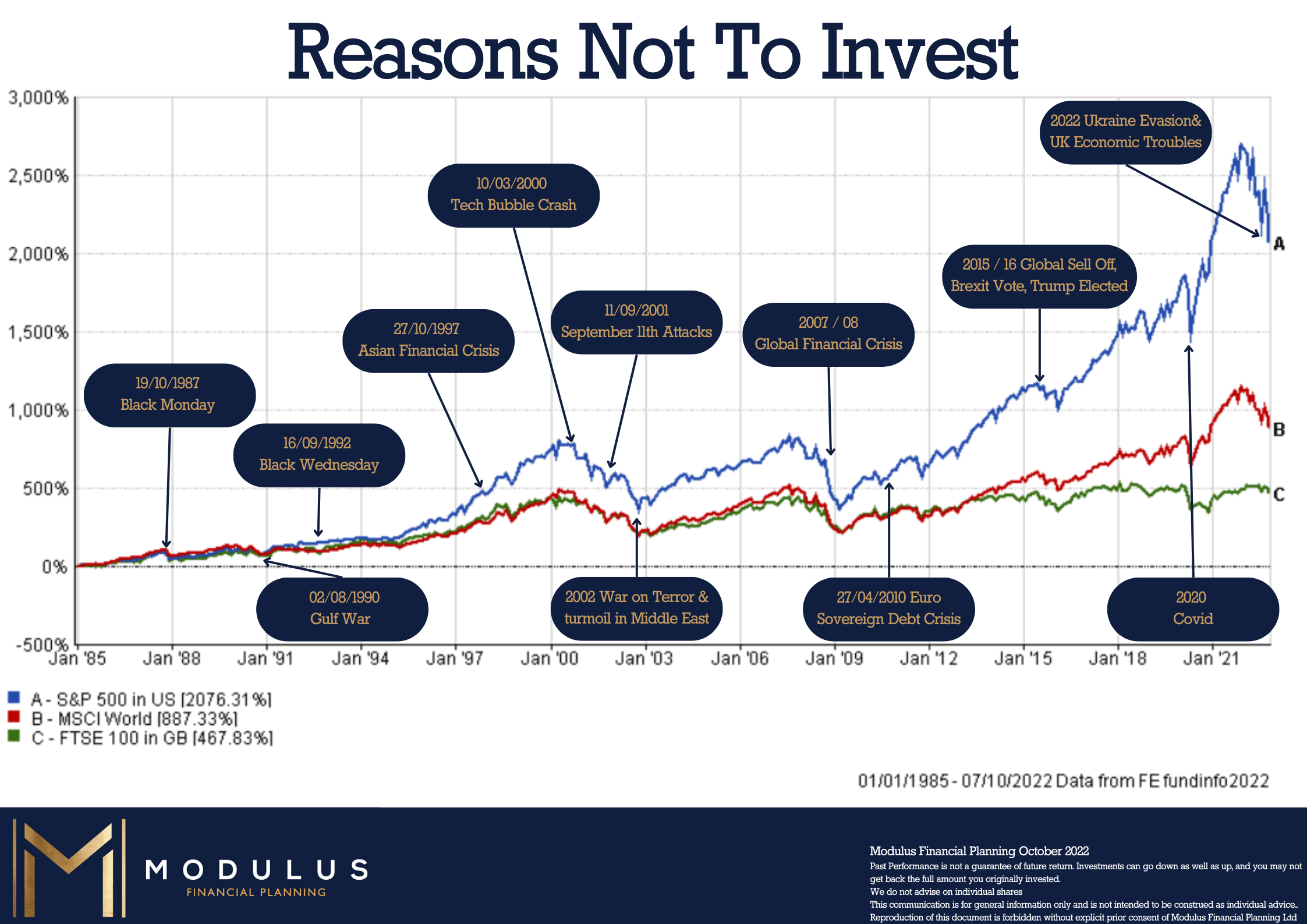

If we go back further in time, then we can see that since 1985 there have been numerous reasons not to invest or remain invested (see below).

This image shows the movement of the S&P 500, MSCI World and FTSE 100 since 1985 along with events that have affected the markets – reasons not to invest.

The following happened between 1985 & 2022 –

- Back to the Future was released (1985)

- Numerous wars

- 9/11 Attacks

- Multiple recessions including a meltdown of the Global financial system

- Britain voted to and then left the EU

- There was a global pandemic which shut down most of the world

- Donald Trump would be voted in and serve as president of the most powerful nation on earth

- There was a sequel to Top Gun – 36 years later!

- A TV actor became president of Ukraine and stood with his people against the might of the Russian

Imagine I had told you all of this would happen back in 1985! You would probably call me a lunatic and remove me from your Filofax contacts! You certainly wouldn’t have changed your views on your financial planning because of it. And, in the very off chance you had believed me, then you may have decided to keep your money under the mattress and have lost out on fantastic returns over this period.

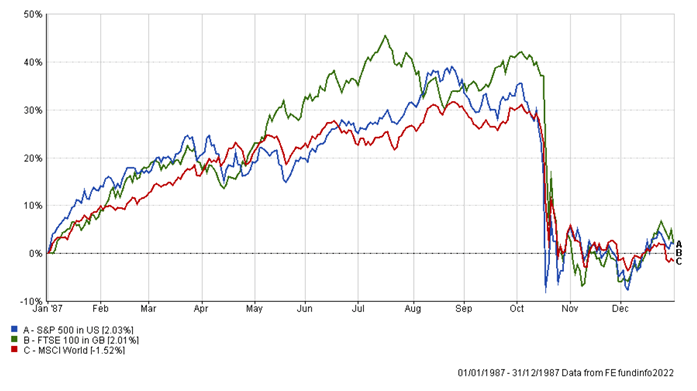

Looking at the chart above, the thing to notice here is that even though there have been periods when the markets have declined and indeed been flat for periods the overall trend has been upward over time. The short term can seem scary because of volatility – here is a look at 1987 when Black Monday occurred!

If you saw this in isolation, then you may be worried about the volatility over the course of the year (remember volatility is the temporary decline / movement in the markets but that risk is the chance of permanent loss).

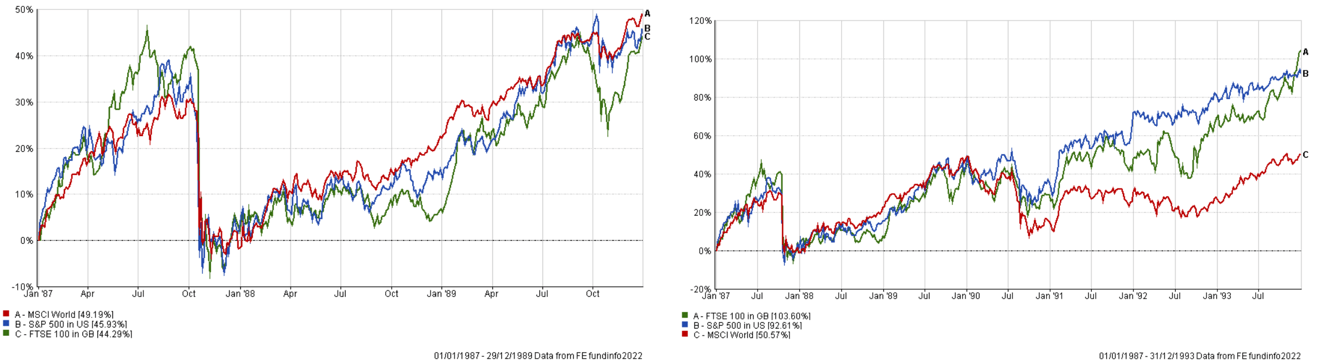

But if we look at the 3-year view and then out to the 7-year view, things seem a little bit more settled. In fact, Black Monday seems like a bit of a hiccup over 7 years. If you look at this over the space of 30 years, then such events are literally small blips on the chart.

Over the short term the stock market is a voting machine. It is a popularity contest to a degree (or even an unpopularity contest at times). People often vote quickly with their hearts and react to short term events. In the long term the market is like a weighing machine, measuring the output of the products and services that the great companies of the world produce and sell. When it comes to investing as part of a financial plan then it can take a strong will to go against the popular crowd at times. It takes courage to stick to the plan at times and to filter out the noise that is blaring all around.

So, what should you do about what is going on with the markets and in the economy in general? Well, nothing really. Review your financial plan when it needs to be reviewed. If you are worried in the short term, then call your financial planner. It is at times like this when a financial planner should be telling you to keep calm and carry on. Making reactionary changes could mean you turn a temporary market decline into a permanent loss. Be patient and stick to the plan!

“The stock market is a device for transferring money from the impatient to the patient” – Warren Buffet

And if you’re worried about what the papers and various commentators are saying about the economy then always remember the sage words of Marty McFly!

“Since when can weathermen predict the weather, let alone the future?”

Past Performance is not a guarantee of future return. Investments can go down as well as up, and you may not get back the full amount you originally invested.

We do not advise on individual shares

This communication is for general information only and is not intended to be construed as individual advice.

Details correct as of time of writing 10th October 2022