New Year, New You! That’s what we’re about to be inundated with. Whether its for the latest exercise workout (Peloton and Hydrow – I’m looking at you) or the latest diet and turn to veganism fad. Dry January will kick off again to help us start the year healthy. Is there anything we can do with our finances?

I’m a big fan of regularly reviewing your finances. January is as good a time as any to start new habits, but there needs to be a reason behind it, otherwise you’ll never keep it up. If you’re already saving regularly (whether that’s into your ISA, Pension or other account) then maybe you can review it and increase the amount? All too often, we set the amount as an arbitrary figure (£100, £250 and £500pm seems common) but we never change it. Even though we get pay raises, change jobs and get pay jumps, bonuses, or we finish paying down debts. If you’re serious about making meaningful savings, you should always review your saving rate – the amount of your income you are saving.

Some Motivation to Kick Start The Habit

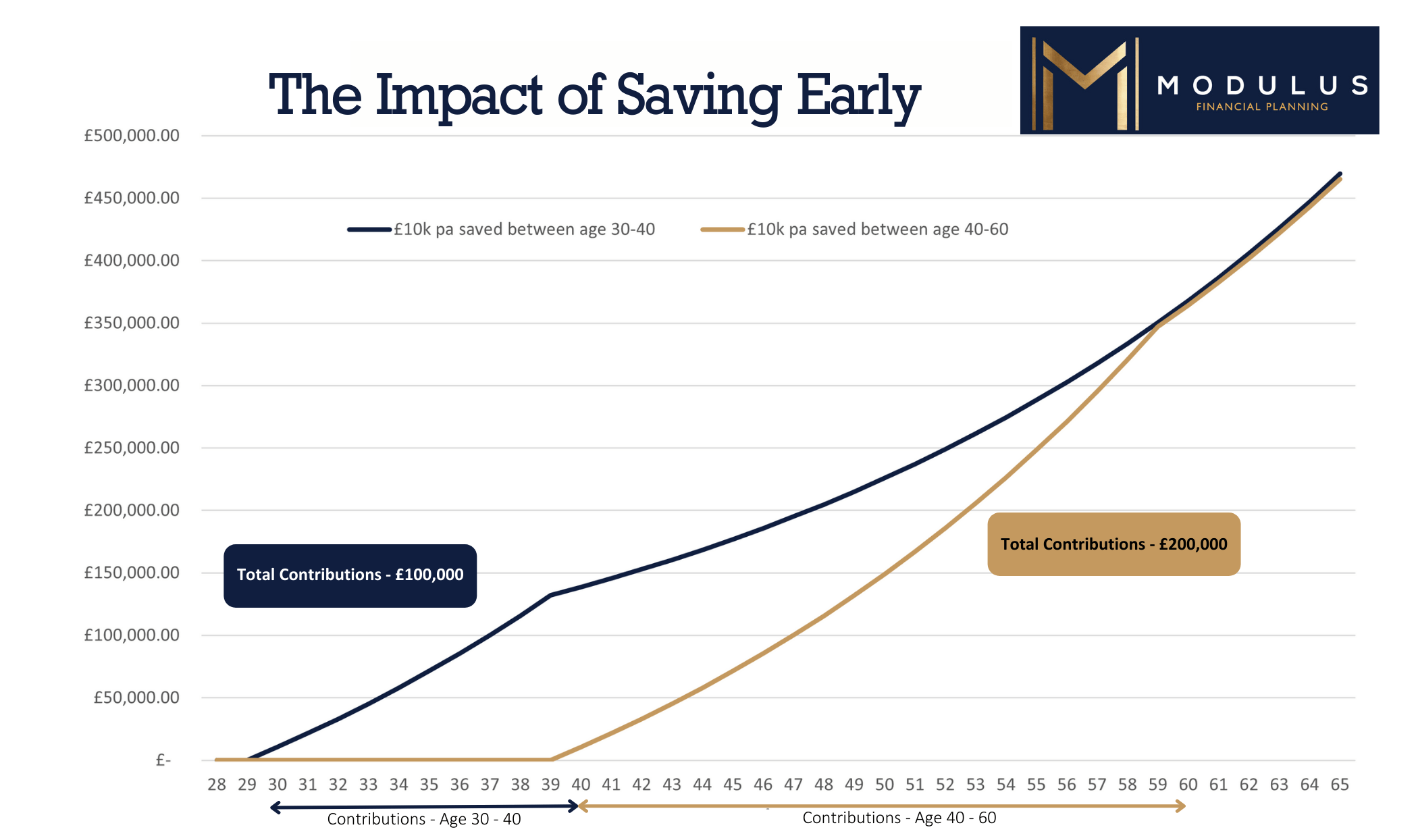

Here’s an example of two savers.

Henry begins to save £10k per annum when he turns 30 and saves it every year until he turns 40. Then he stops saving. In total he saved £100k out of his pocket.

Henrietta waits until she is 40 and begins to save £10k per annum. She, however saves for 20 years, until she is 60 and so she saves £200k out of her pocket.

Both have saved in an account where they are making an annual return of 5%

Who ends up better off?

Compound Interest

Henry started 10 years earlier, and so he has 10 years additional growth. This means he benefits more from compound interest.

Einstein “Compound Interest is the eight wonder of the world. He who understands it, earns it… He who doesn’t, pays it…”

Compound interest is essentially earning interest (growth) on already earned interest (growth). That is why all projections are generally a curved line rather than a straight line. The earlier you can invest, and the longer you leave it, the more you will benefit from compound interest.

This is why we always like our clients (and their children) to start saving early and let compound interest do the heavy lifting.

Henry vs Henrietta

So, let’s get back to Henry vs Henrietta. Who is better off when Henry started earlier, but Henrietta saved twice as much in total?

Well, in this example, I’ve built in such a way that they are almost equal at age 60. The figures show relatively little difference. When Henry is aged 60, he has £350,000 whereas when Henriette is 60, she has £347,000.

Growth on Growth

But to prove compound interest and show how growth on a big number can have a huge impact, over the next five years, neither contribute any further money. If they earn 5% each year, their approximate £350k grows to £469,500 and £465,000 respectively – another £115-120k.

There is a guy called Charlie Munger, who is the vice chairman of Berkshire Hathaway and the right hand man to Warren Buffett, who has a famous quote “The first $100k is a bitch.” He said this because the initial growth or interest on a smaller amount doesn’t amount to much, but once you already have a healthy amount saved, then the interest does amount to something. And so he is of the belief you should always aim for your first $100k, but the next goal shouldn’t be $200k, it should be more like $1 million, because natural growth will do the heavy lifting to get you there.

Start a Good Habit

So set yourself up with a good habit by starting to save now. Or if you’re already saving, increase the amount. As we’ve shown, the earlier you start, the less you need to save. If you leave it too late, you’ll need to save more to get to the same place.

Remember, investments can go down as well as up, and you may not get back the full amount you originally invested.